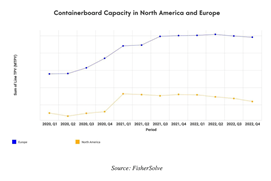

Consolidation is in sight in paper and packaging! The American company, International Paper, and the British company DS Smith announced that they have reached an agreement on the terms of their merger. The bid, which values DS Smith at $7.2 billion, replaces the Mondi Group’s offer, valued at $6.3 billion. If the acquisition of DS Smith by International Paper goes through, it should be completed by Q4 of 2024. This would create a new group generating nearly $28 billion in revenues and $4.1 billion in EBITDA. International Paper expects that approximately 33% of synergies will be realized in the first year, then 66% in the second year and 95% in the third year after the transaction. Andrew K. Silvernail, who will become International Paper’s CEO on May 1st, will also become the CEO of the combined company and Miles Roberts, DS Smith’ CEO will remain on as a consultant to help with the integration. The merged company’s headquarters will be in Memphis, Tennessee. EMEA headquarters will be at DS Smith’s current headquarters in London.

Published on 25/04/2024